As geopolitical tensions increase worldwide, investors traditionally flee to safe havens. Gold soars to record highs. Bitcoin (BTC), once presented as the digital alternative, is doing just the opposite: the coin is being sold en masse.

Bitcoin price under pressure, gold at record highs

The Bitcoin price fell sharply last weekend and even fell below $87,000. This is striking, considering that BTC reached an all-time high of $126,000 in October. Since then, profit-taking by long-term investors has created strong selling pressure.

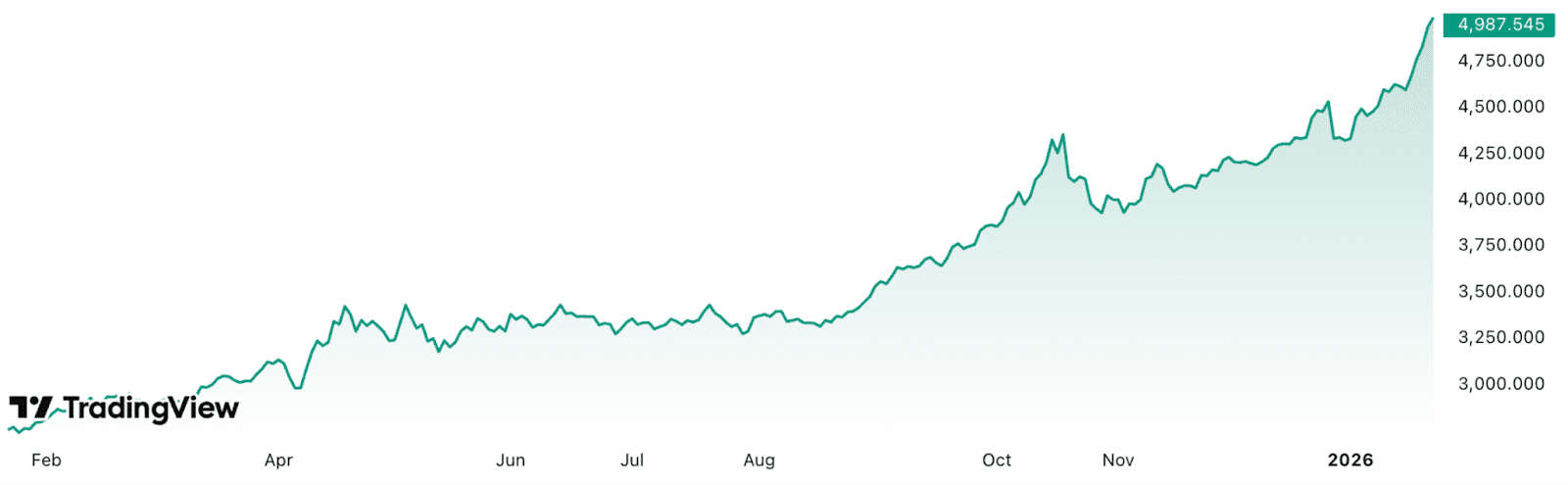

At the same time, the gold price continues to rise unabated. The precious metal set a new record last Friday of approximately $4,987 per ounce, an increase of no less than 90 percent since the beginning of last year. Gold thus seems to confirm its status as the ultimate safe haven.

Annual chart gold – Tradingview

Fear of cycle repeat weighs on BTC

According to market researchers from the American investment company NYDIG, Bitcoin is losing ground as a hedge against geopolitical unrest. They point to lingering fears of a repeat of Bitcoin’s four-year cycle, where previous bull runs invariably turned into extended corrections. That pattern continues to influence investor sentiment.

This uncertainty ensures that BTC is used more often to quickly release liquidity. Not because it is fundamentally unreliable, but precisely because it is relatively easy to trade. In times of stress, institutional parties prefer to dump their tactical BTC positions rather than their strategic gold holdings.

Gold remains a favorite of central banks

NYDIG emphasizes that gold is still widely accepted within institutional portfolios, something Bitcoin currently lacks. For example, China bought an estimated 254 tons of gold last year, while Poland added more than 83 tons and wants to buy another 150 tons, according to Bloomberg.

BTC has not yet achieved that institutional status despite the rise of spot exchange-traded funds (ETFs). The correlation with risky stock markets remains high, making the digital asset seen as a speculative investment rather than a structural buffer.

BTC as digital gold?

NYDIG concludes that as long as markets believe crises are temporary, gold will remain the preferred choice. Only when investors start to factor in structural risks, such as hyperinflation or monetary censorship, can Bitcoin realize its value as digital gold.

Source: https://newsbit.nl/waarom-faalt-bitcoin-als-veilige-haven-terwijl-goud-blijft-stijgen/