Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not constitute financial advice. Investing in cryptocurrencies or pre-sales involves significant risks, including the risk of losing your entire investment. Always do your own research before making any investment decisions.

The crypto market is at a delicate point as Bitcoin ETFs experience significant outflows, undermining investor confidence in major assets. At the same time, Cardano holders are growing impatient as there are persistent weaknesses on the chain. Newer, usage-oriented projects such as Remittix, which have recently gained interest, are being considered in this environment as capital moves from stagnant giants to new entrants.

Bitcoin ETFs under pressure due to macroeconomic concerns surrounding BTC

Pressure on Bitcoin ETFs has increased again this week, reinforcing the argument that institutional confidence is declining in the near term. Bitcoin is currently trading around $89,206, following its inability to break the $90,000 mental barrier. The United States is also contributing to the volatility with threatened import tariffs, and even indirect geopolitical statements have caused strong reactions in the crypto market.

Bitcoin ETFs have experienced five straight trading days of net outflows, leading to nearly $1.72 billion in outflows from BTC-related products. On January 23, $103.57 million in capital was withdrawn, reducing total assets under management from $124.56 billion to $115.88 billion. These numbers bring current selling pressure to the same level as during November’s aggressive liquidation phase.

Currently, Bitcoin ETFs are in a defensive position. The critical support level is between $88,400 and $90,800, and market strength can only be regained at a level between $92,000 and $93,500. Until that happens, institutional resistance will continue to put pressure on the entire market. Analysts may therefore predict prices around $40,000 as traders look for alternatives outside of Bitcoin.

Cardano struggles as whales retreat

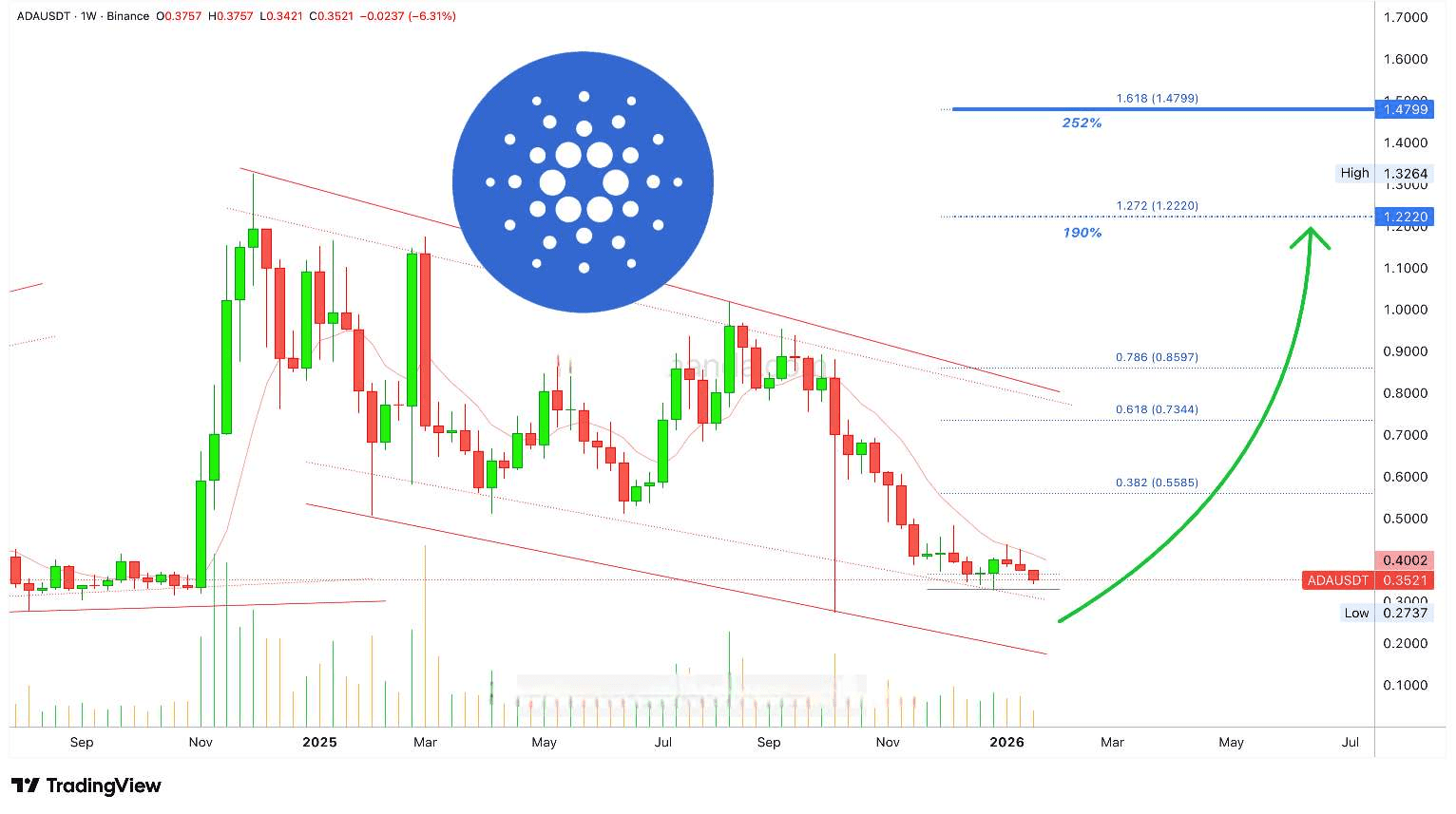

Although Cardano has long been seen as a long-term infrastructure project, short-term sentiment is waning. ADA is currently trading around $0.358 and trading volume is down over 43% in the last 24 hours. This decline reflects reduced activity rather than aggressive accumulation, and is concerning in an already uncertain market.

Technical analysts point out that Cardano has fallen under a compressed price structure, below a declining trend line. Any price above $0.355 could herald a slight recovery move towards $0.370-$0.380; a fall below USD 0.350 could push ADA back to USD 0.340 or lower. However, analysts such as Ali Martinez believe that the price will recover by at least 7%.

More worrying is the behavior of large holders. Wallets with between 10 million and 100 million ADA have reduced their exposure by around 20 million tokens, and mid-range wallets have also reduced positions. Cardano does not have the purchasing power to turn the tide independently without the help of whales. This impasse is forcing some ADA holders to look for alternative projects, especially those with clear growth drivers.

Why Remittix is becoming the new viral sensation

With Bitcoin ETFs losing capital and Cardano holders facing declining momentum, buyers aren’t simply looking for random alternatives. They are shifting to projects that combine real applications with visible implementation and scarcity, such as Remittix. This project has already raised over $28.8 million and sold 701 million tokens at a price of $0.123. This means that more than 93% of the total supply of 750 million tokens has already been sold. This demand has created real urgency, as investors realize there is little room left to get in at early prices.

Execution is just as important. The Remittix wallet is already launched and operational on the App Store, with a release on Google Play expected shortly. This is not a theory or prototype, but a working product that is actively used. Remittix has also passed a thorough CertiK audit, one of the most respected names in blockchain security.

Looking ahead, Remittix has a clear catalyst that many early-stage tokens are missing. The project has announced that it will launch its crypto-to-fiat platform on February 9, 2026, giving the market a clear date to price in growth in adoption and usage. With CEX listings confirmed on both BitMart and LBank, access and liquidity are already increasing ahead of that launch. Key reasons why investors are flocking to Remittix are:

- More than $28.8 million raised with 701 million tokens sold, leaving less than 7% of the total supply available and creating massive scarcity pressure

- Live Remittix wallet available in the Apple Store, proving the ecosystem is operational and not a theory

- CertiK audited, which drastically reduces risk and increases long-term confidence

- Confirmed CEX listings on BitMart and LBank, providing broader market access

- Crypto-to-fiat platform launches on February 9, 2026 and offers a clear roadmap

- Designed with low transaction fees, optimized for payments and transfers, not speculation

- Web app almost complete, intended to fully weave fiat integration into the Remittix ecosystem

Why market rotation is accelerating

This market phase underlines a familiar pattern. Bitcoin ETFs are hemorrhaging capital, large altcoins like Cardano cannot take over, and the market is shifting to smaller projects with growth potential. Investors focus on practicality, execution and scarcity — not on vague stories. Remittix fits well into this rotation. As conversations about “the next big altcoin of 2025” gain momentum and real-world payments become more central, both the narrative and the actual execution are moving in RTX’s favor.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Frequently asked questions

What is the best crypto to buy?

The best cryptocurrency to buy now depends on your risk tolerance, although most investors are currently shifting towards projects with real products and immediate catalysts. While large caps are experiencing ETF outflows and weak momentum, tokens like Remittix have live wallets, confirmed stock exchange listings, and a planned crypto-to-fiat launch.

Should you invest in crypto now?

The crypto market is unpredictable, but times of uncertainty often offer opportunities. With Bitcoin ETFs under pressure and traditional altcoins faltering, investors are opportunistically investing in newer projects with strong fundamentals. Strategic entry during rotation phases can offer more upside potential than chasing already overstretched large caps.

How do I find new early-stage crypto projects?

Finding new crypto projects early requires tracking presale dates, funding milestones, audits, and product launches. Investors often look for audited tokens, working applications, confirmed exchanges and clear roadmaps. Projects like Remittix are attracting attention because they combine early pricing with real usability and visible execution.

Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not constitute financial advice. Investing in cryptocurrencies or pre-sales involves significant risks, including the risk of losing your entire investment. Always do your own research before making any investment decisions.

Source: https://newsbit.nl/persberichten/bitcoin-etfs-opnieuw-onder-druk-terwijl-cardano-houders-overstappen-naar-deze-nieuwe-virale-sensatie/