The shares of chip companies BE Semiconductor Industries (BESI) and ASML have started the new stock market year with notable price increases. Investors are showing enthusiasm, which means the semiconductor sector is off to a flying start in 2026.

BESI price rises by more than seventeen percent

BE Semiconductor (BESI) continues its positive momentum and opens the stock market week with a strong plus. The share rose by more than four and a half percent on Monday to almost 156 euros. That is an increase of more than seventeen percent compared to the closing price at the end of December 2025.

The technology company from Duiven makes machines that prepare chips for use in, for example, smartphones, cars and data centers. BESI focuses on the final production step, where semiconductors are attached, tested and protected before they end up in electronic devices.

Investors seem to be anticipating a strong year for the chip industry, in which BESI as a supplier will fully benefit from growing demand.

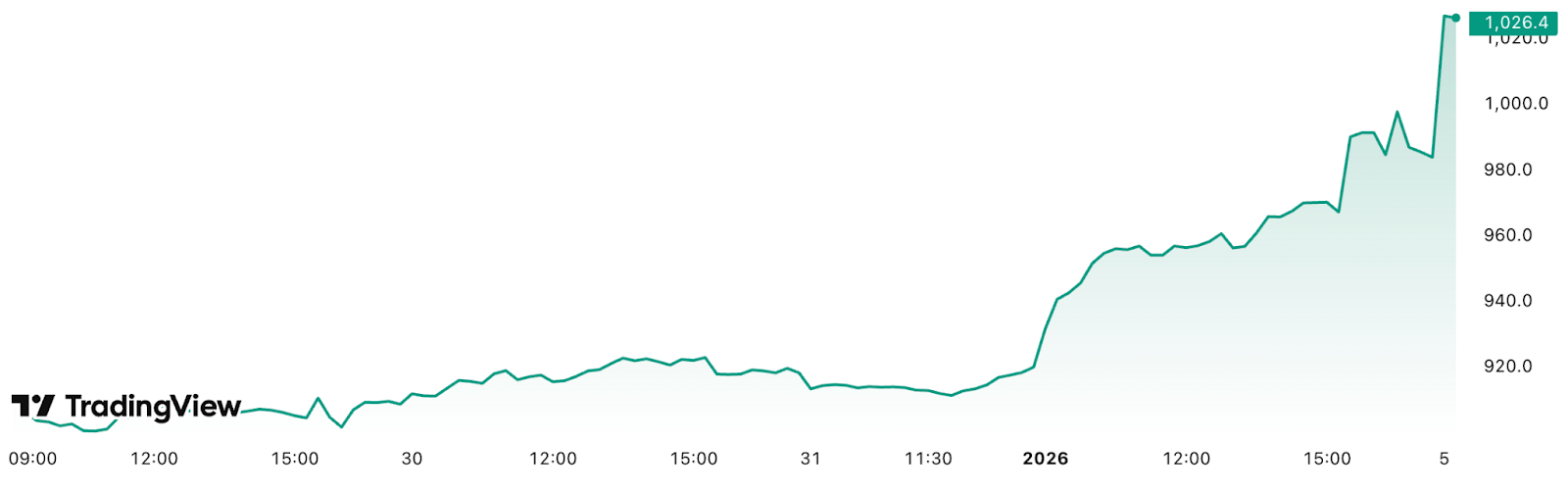

ASML, manufacturer of advanced chip machines from Veldhoven, also shows an impressive price increase. Since the beginning of the year, the share has risen by almost thirteen percent to above 1027 euros. This has reached a new record price, well above the previous high of summer 2024.

Yet there are also warning sounds. A technical analyst from Echo Analysis states that ASML is in the fifth and final upward wave according to the Elliott Wave theory. “There is still room for an increase of 23 percent,” the analyst said. “But investors should remain alert to signs of exhaustion and consider profit taking.”

Bernstein raises price target to $1,528

At the same time, investment bank Bernstein remains positive about ASML. The analysts have adjusted their advice from ‘Market Perform’ to ‘Outperform’. The price target has also risen considerably: from $935 to $1,528. The bank thus expresses confidence in ASML’s strong market position within the global chip industry.

Investors thus receive conflicting signals. On the one hand there is optimism about the company’s growth opportunities, on the other hand there are technical warnings. This makes ASML a share that is closely monitored.

Source: https://newsbit.nl/chipreuzen-besi-en-asml-knallen-het-jaar-in-met-sterke-koerswinsten/