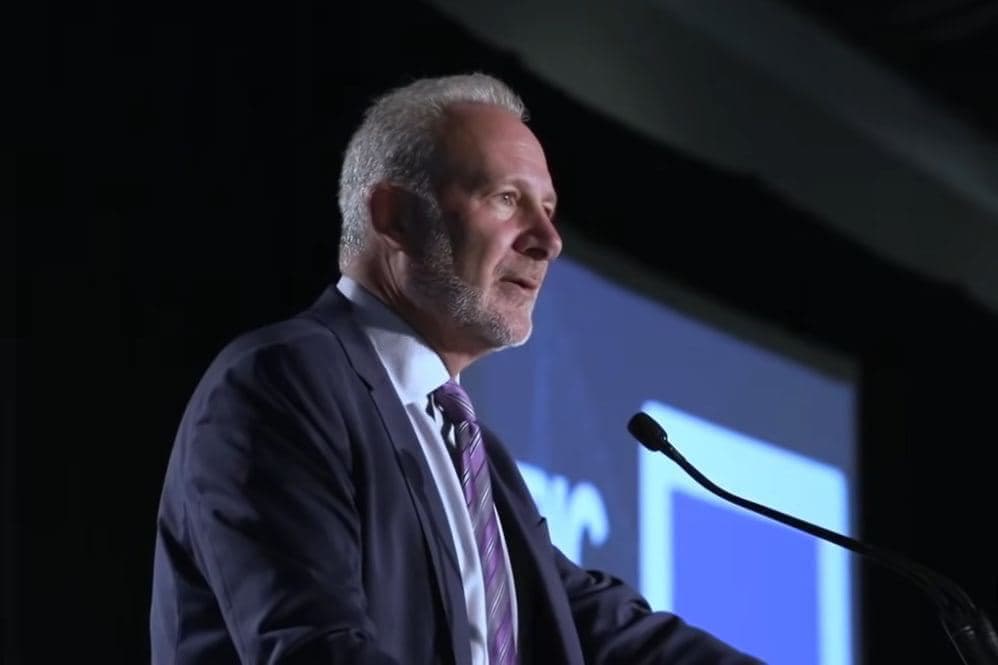

American economist Peter Schiff is once again sounding the alarm about the future of the global economy. According to him, the world is on the brink of a massive financial shift, with potentially disastrous consequences for the US dollar.

Central banks are turning their backs on the dollar

In a recent post on According to him, central banks worldwide are increasingly moving away from dollar reserves and opting for gold instead. He sees this as a sign of declining confidence in American monetary policy.

Schiff argues that this shift robs the US of its unique advantage: being able to borrow cheaply and finance large deficits. Now that that privilege is disappearing, there is a threat of a scenario in which inflation continues to rise and financial instability increases.

Debt, inflation and distrust are growing

Schiff links the weakening of the dollar to structural problems in the American economy, such as rising national debt, chronic budget deficits and rising interest costs. According to him, these factors mean that policymakers have fewer and fewer options to achieve a soft landing.

He warns that efforts to support the economy will ultimately lead to further weakening of the dollar, increasing the risk of stagflation.

Gold rises, crypto lags behind

According to Schiff, investors are now flocking to precious metals. He sees the rising gold price not as a sign of economic strength, but as a warning: investors are protecting themselves against currency risks and system stress.

At the same time, Schiff remains critical of Bitcoin (BTC) and other cryptocurrencies. Despite price increases, BTC has still not proven to be a reliable safe haven, according to him. “If there is a real crisis, investors will still choose gold,” he says.

Source: https://newsbit.nl/peter-schiff-waarschuwt-historische-economische-ineenstorting-op-komst/