A series of strong comments about the rapid growth of the AI sector is once again causing tension on the financial markets. While investments in AI hardware and data centers continue to increase, some analysts question whether this growth is sustainable. The central question is whether the market is not once again embracing a scenario that is too rosy.

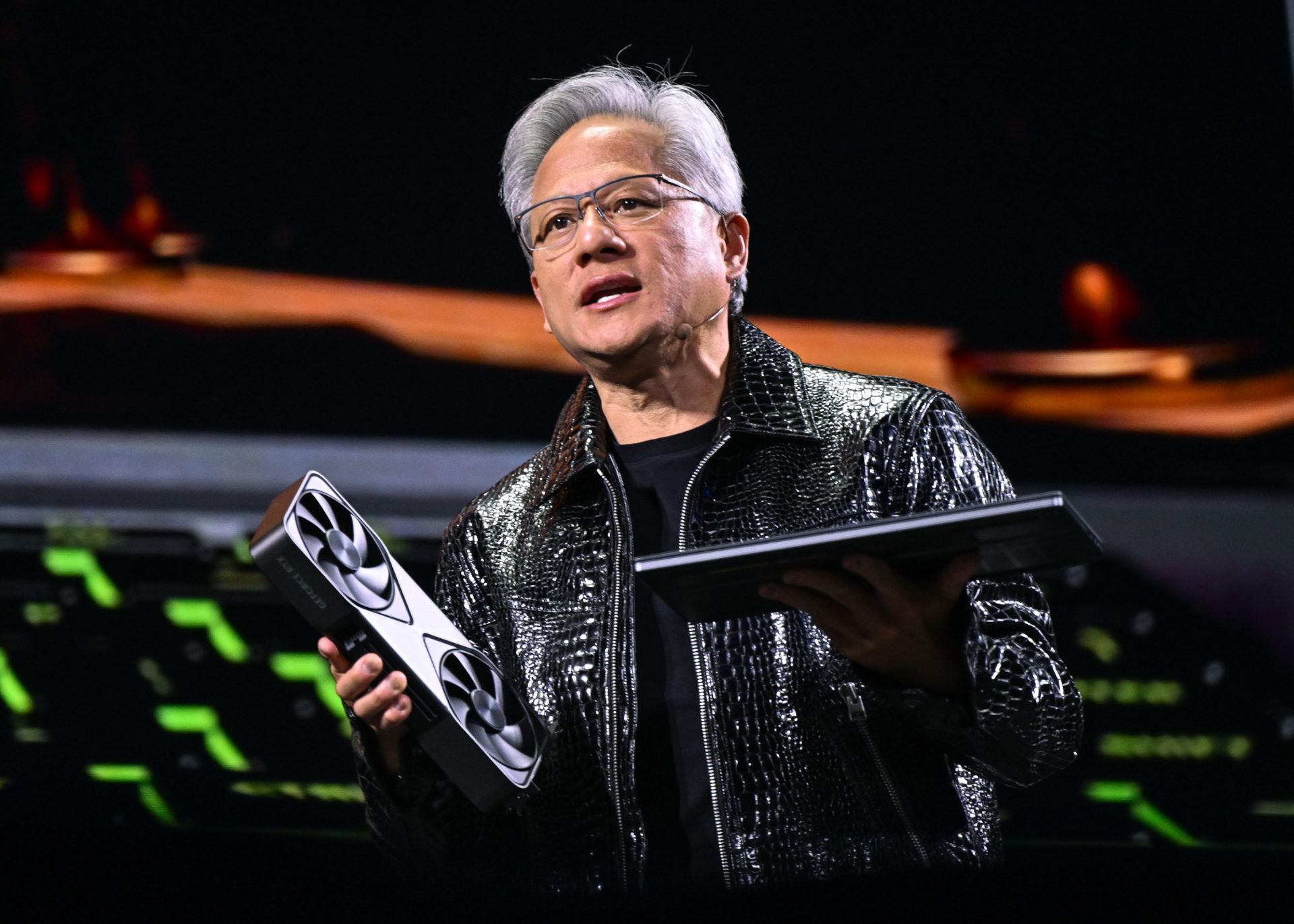

Nvidia responds to Burry’s AI bubble criticism

Tensions rose this week when Nvidia quietly sent a seven-page memo to major analysts, in which the company directly responded to criticism from well-known “Big Short” investor Michael Burry. He became famous for making a fortune from the 2008 American housing crisis.

According to previous reporting from Barron’s, the memo refers to several comments made by Burry on X, where he repeatedly warns of a new bubble.

The discussion comes at a time when Nvidia is under pressure on the stock market. Due to increasing competition, especially from Google that is increasingly using its own AI chips, Nvidia has lost approximately $250 billion in market value in recent weeks. The sharp drop in prices follows signals that demand for AI chips is growing faster than Nvidia can supply, causing customers to increasingly turn to alternatives.

Burry argues that the current AI wave is reminiscent of the telecom boom of the late 1990s. According to him, companies make similar assumptions about growth and hardware usage, justifying billion-dollar investments. In a response to Substack, he wrote: “Nvidia emailed a memo to Wall Street to refute my arguments about stock rewards and write-offs. I stand by my analysis.”

In the memo, Nvidia corrects Burry’s calculation of the share buyback, among other things. According to the company, $91 billion in shares have been repurchased since 2018, not $112.5 billion as Burry claims. According to Nvidia, he incorrectly included the tax on allocated employee shares, while according to the company the stock compensation is in line with that at other large tech companies.

Discussion about lifespan of Nvidia chips

Nvidia also responds to the criticism of the depreciation periods. Burry suggests that customers overestimate the lifespan of Nvidia GPUs to justify large investments. Nvidia says customers typically depreciate their chips over four to six years and that older models, such as the 2020 A100, are still heavily used.

In addition, Nvidia is responding to Burry’s warning about so-called “circular financing”, in which companies would support demand for their own products through strategic investments. According to the company, this only concerns a small part of the turnover.

In his analysis, Burry compares Nvidia with Cisco, a major American supplier of network equipment that grew into a key figure in the enormous investment wave in internet infrastructure during the dot-com bubble.

On the eve of the bubble bursting, it eventually turned out that a large part of the fiber optic installed was not being used at all. According to Burry, the question now is whether the plans for AI infrastructure are not based on equally optimistic assumptions.

Source: https://newsbit.nl/big-short-waarschuwt-voor-ai-bubbel-maar-nvidia-slaat-hard-terug/