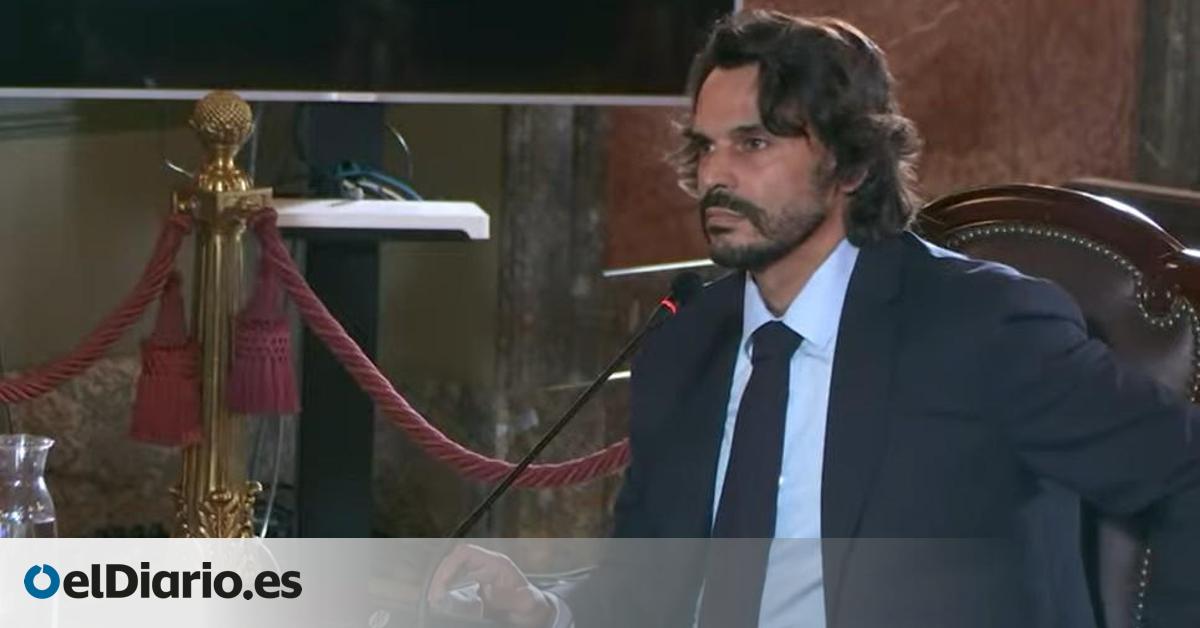

The Provincial Court of Madrid has confirmed the prosecution of Ayuso’s partner for two crimes of tax fraud in competition with another of document falsification. The judges of the higher instance confirm the decision of the previous magistrate in the case to order the end of the investigation and propose that the businessman and commission agent Alberto Gonzalez Amador be tried, according to the order of the Third Section to which elDiario.es has had access.

In another order from the same section, the magistrates reject the practice of investigations that González Amador’s defense had requested and that the court investigating him had already denied. These decisions of the Provincial Court lead the couple of the Madrid president to trial since the next order that the judge in the case must issue, the one to open an oral trial, is not appealable. The Prosecutor’s Office and the State Attorney’s Office (representing the Tax Agency) each request 3 years and 9 months in prison for the Madrid president’s partner.

This is the main piece of the case. Meanwhile, the same Court, Investigative Court number 19 of Madrid, continues to investigate González Amador for alleged business corruption and unfair administration. This is a separate piece that investigates the purchase of a company by Ayuso’s partner that could be covering up the covert payment to his partner of a percentage for the mask commission that is at the origin of the two investigations. His partner is Fernando Camino, president of Quirón Prevention, a division of the private healthcare giant that receives almost one billion euros annually from the Community of Madrid.

González Amador’s defense alleged that he was going to go to trial without having given a statement during the investigation phase. The Madrid Court reminds him that, when he was summoned, he took advantage of his right not to testify, contrary to what he did in the piece for corruption in business.

After his prosecution, Ayuso’s partner had also requested the testimony of witnesses and the presentation of an expert, something that he had avoided proposing throughout the investigation. “The requested testimonials are not strictly necessary or useful to clarify the facts under investigation, having been proposed to complete the tax expert report provided out of time (…)”, states the order of the Third Section.

In the order specifically intended to reject the proceedings proposed by Gabriel Rodríguez Ramos, González Amador’s lawyer, the judges of the Court reject the testimony of some witnesses with whom the accused intended to demonstrate that he had traveled to the Ivory Coast to carry out work whose expenses he declared and that the Tax Agency considered a fictitious invoice.

“Without prejudging at all, for the purposes of this resolution, his testimony has little practical potential to neutralize the indications indicated by the Tax Agency,” the judges establish. The judge had already warned that she does not question the trip, but notes that González Amador’s company never spent 922,585 euros in the African country. This false invoice was declared by González Amador on October 1, 2021, after his relationship with the Madrid president emerged.

The false invoice from Maxwell Cremona SL, the parent company of González Amador, “was already aware that the sales operation [en Costa de Marfil] It was not going to happen given that it had been publicized who was awarded the contract with the country’s health authorities,” the magistrates add about González Amador’s deception.

Regarding the incorporation of the expert opinion presented by the defense, the judges recall that it was not presented during the investigation phase, which has lasted more than a year and a half. “The right to evidence is neither absolute nor unconditional,” the judges of the Supreme Court jurisprudence recover. It must be, they add, relevant, while indicating to the accused that he can always present it during the trial.

Source: www.eldiario.es