Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not form financial advice. Investing in crypto currency or presales entails significant risks, including the risk of losing your full contribution. Always do your own research before you make investment decisions.

Large coins show strong profits, but not all digital tokens move in the same direction. While some prices are rising, others have to deal with setbacks. Recent market movements have shaken both new and experienced traders. What drives these trends, and which asset is not able to get along well? Read on below.

Bitcoin (BTC)

Bitcoin acts in a narrow bond between 108,815 and 115,589 after a strong advance. The currency won 4.64% in the last 7 days and 8.60% over 4 weeks. BTC 41.54% is higher at 6 months, which indicates solid medium -term power, without clear outbreak.

The short-term average is around 118,597, just above the current band, while the 100-day average is 113,925. Momentum indicators remain positive: RSI at 68 and Stochany in 69 point to firm but not exhausted buying behavior. A positive MACD value of 833 reinforces the image that the bulls are in charge.

The next battle is at 118,919. A lock above it can push BTC towards 125,693, about 10% above the current ceiling. If sellers intervene earlier, the coin can seek support at 105,372, and a deeper decrease to 98,599 would remove 8% to 14% of the value. The chances remain up as long as the price above 113,000 is noted.

Ethereum (ETH)

Ethereum trades between 3828 and 4459 dollars and is 141.88% higher in 6 months. This sharp increase brought the coin into the spotlight again, although the pace has since weakened.

In the past 7 days, ETH has risen by 5.68%, more than 1.82% over 30 days. A momentum score of 63.80 indicates healthy interest, but no exaggeration. The rate is just below the $ 10-day average of $ 4378, but still above the 100-day line at 4178. This offers a buffer in the zone 4178-4459 and shows that traders get in with dips.

If buyers break through the next resistance to 4775, ETH can rise towards 5405, about 15% -20% higher than now. If the floor does not last at 3828, 3513 is in sight, a decrease of approximately 10%. A deeper fall to 2882 would remove almost 25%, although the long-term trend remains positive as long as the 100-day line rises. Bulls aim for a breakthrough above 4775, while Bears look forward to a lock below 4178. Until one of the two wins, a sideways game within the band of 4000-4500 probably seems likely.

Undervalued $ xyz meme coin is preparing for a listing on large CEX

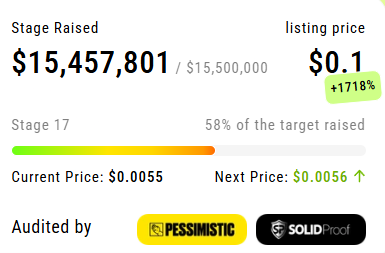

Xyzverse ($ XYZ) is the meme coin that attracted attention with the ambitious claim to rise from 0.0001 dollars to 0.1 dollars during the presale.

So far, half of this goal has been achieved: more than 15 million dollars has been collected and the price of the $ XYZ token is currently at $ 0.0055.

In the next presal phase, the value of $ XYZ increases further to $ 0.0056, so that early investors can bring in a larger discount.

After the presale, $ XYZ will be noted on large centralized and decentralized fairs. The team has not yet released details, but hinted on a large launch.

Born for fighters, built for champions

Xyzverse builds a community for those who are hungry for large crypto winsts-the tireless people, the ambitious, the fighters who aim for dominance. This is a coin for real fighters, a mentality that appeals to both athletes and sports fans. $ XYZ is token for thrillseekers who hunt for the next big meme coin.

Central to the Xyzverse story is Xyzepe-a fighter in the meme-coin-arena who wants to storm the rankings and reach the top of Coinmarketcap. Will it be the next doge or shib? Time will learn it.

The community is in charge in Xyzverse. Active participants receive generous rewards and the team has assigned no less than 10% of the total token stock – around 10 billion $ XYZ – for AirDrops, making this one of the largest airdrops ever.

With strong tokenomics, strategic CEX and DEX listings and regular token Burns, $ XYZ was built for a championship run. Each move is aimed at strengthening the course, stimulating price increases and building a loyal community that knows that this can be the start of something legendary.

Airdrops, rewards and more – join XYZONSE to discover all the benefits.

Solana (Sol)

Sol acts in a broad band of 188.99-234.99 dollars after a solid jump of 6.11% this week and 13.89% profit since the beginning of last month. The image is even stronger in the longer term; The currency rose 83.09% in 6 months, making the $ 10-day average at 223.33 dollars, well above the 100-day line at 211.06. This points to constant demand and a market that continues to lean up.

The next resistance is at $ 259, with a heavier ceiling at 305. Momentum indicators support the bulls; The RSI is 65 and the stochastic at 71.75, both point to strong purchasing pressure but no overheating yet. A positive trend meter of 2.81 emphasizes this image. On the other hand, buyers look at 167.03 as the first safety net and 121.03 as deeper soil.

If Sol closes above 234.99, the door opens to 259, an increase of approximately 11%. Above that point a jump to 305 can follow, about 30% above the current top. If the 10-day line does not hold, a fall in the direction of 167, almost 25% lower, but the wider 6-month trend continues to indicate higher tops. For now, momentum and structure suggest that dips remain buy -worthy as long as 211 persists.

Ripple (XRP)

XRP noted this week an increase of 1.97% within the tire 2.71-3.01 dollars. On a monthly basis there is +8.25% and in 6 months +40.27%. The course remains above both the short and long averages, a sign of stable question.

The $ 10-day at 2.97 dollars is now above the 100-day line at 2.88. Momentum remains sturdy; The RSI is at 64.98 and the stochastic at 83.84, both just below Overbought site. A positive MacD of 0.0222 gives extra support. If this momentum holds, the coin can first push through to $ 3.16, about 5% above the current band, and then to 3.46, about 15% higher.

The support is at 2.55, approximately 9% below the ceiling of the tire, with a deeper buffer at 2.24, 25% lower. As long as the rate remains above the shorter average, the chances of further rise are greater. However, a lock under 2.55 would turn the tone and heralds a decrease to the second support. For now, patience pays off, with a clear scenario of gradual profit and a path that can yield another 10% -15% extra before the next sturdy resistance looms up. This is the image that traders will take on week two of the month.

Conclusion

BTC, ETH and Sol give strength to the Rally of 2025; XRP remains stable but is a bit behind. Still promising, although XRP followers point to Xyzverse (XYZ), a sporty meme coin that aims for the passing of Pepe and Mog.

You can find more information about Xyzverse here (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not form financial advice. Investing in crypto currency or presales entails significant risks, including the risk of losing your full contribution. Always do your own research before you make investment decisions.

Source: https://newsbit.nl/bitcoin-ethereum-en-solana-leiden-marktherstel-terwijl-xrp-moeite-heeft-om-steun-vast-te-houden/