The XRP rate briefly touched the 3 dollars this week, the highest point in almost two weeks. Speculation about a possible approval of an XRP Exchange-Traded Fund (ETF) in the United States caused renewed interest among investors. Yet analysts indicate weak foundations, so that the question lingers: can XRP be pushed to $ 3.60?

Institutional investors increase their role

Interest from professional parties has increased in recent weeks. According to data from Coinglass, the demand for XRP Futures increased by 5 percent compared to a month earlier, good for a total of $ 7.91 billion. Futures are term contracts with which investors speculate on the future course, without actually having to buy the coin.

It is more striking that the number of outstanding XRP Future contracts on the Chicago Mercantile Exchange (CME) increased by 74 percent to 386 million XRP. This points to an increasing role of institutional investors and market makers.

Important to know, with futures lung and short positions are always opposed to each other. Long means that someone speculates on an increase, shorts on a decrease. As a result, the increase, in particular, says that more parties become active, not automatically that the course goes up.

Monthly recording 7 percent above the spot market. That is in line with the past month and shows that the question remains reasonably in balance. So there is no extreme pressure in a direction.

XRP lagging behind in Altseason

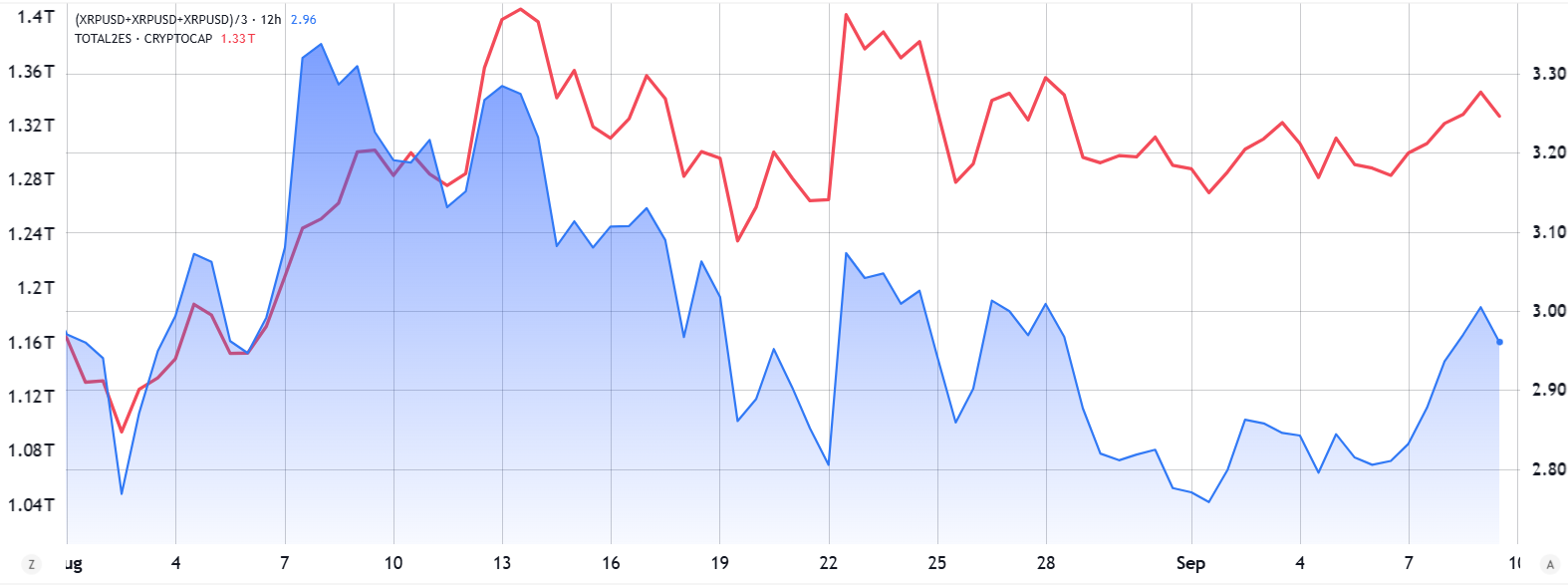

Although the focus on a possible ETF approval is temporarily pushing the course of XRP, the currency performs less strongly than the wider cryptomarket. Since August, XRP has remained almost flat, while the total Altcoin market rose by 14 percent.

Coins such as Solana (SOL), Cardano (ADA) and Ethereum (ETH) achieved considerable profits, while XRP only started moving after completing the legal battle between Ripple and SEC.

The hope for an approval of an American XRP ETF remains the most important motivation. Analysts at Bloomberg estimate the chance of this at 95 percent, although a final decision is only expected at the end of October. If the ETF actually gets the green light, it may be the catalyst needed to push the race again towards $ 3.60

An ETF makes it possible for investors to invest through the stock exchange in XRP without having to possess the coin itself. This lowers the threshold for large parties and can lead to extra capital that the market enters. Earlier examples with Bitcoin and Ethereum show that an ETF usually goes into the market.

Source: https://newsbit.nl/xrp-nadert-3-door-etf-hoop-wat-wordt-de-volgende-stap/