Large listed companies jointly have more than $ 100 billion in crypto currency on the balance sheet. This is shown by new research by Galaxy Research. This creates a new category of companies that use digital assets as a strategic treasury.

Ethereum on the rise

The majority of that value is in Bitcoin. In total, companies such as Strategy, Metaplanet and Gamestop together own more than 790,000 Bitcoin, worth around $ 93 billion. This corresponds to almost 4 percent of the total number of bitcoin that is in circulation.

In addition to Bitcoin, interest in Ethereum is also growing. According to the report, companies are now retaining 1.3 million Ether, with a market value of more than 4 billion dollars. That is good for just over 1 percent of all ether in circulation.

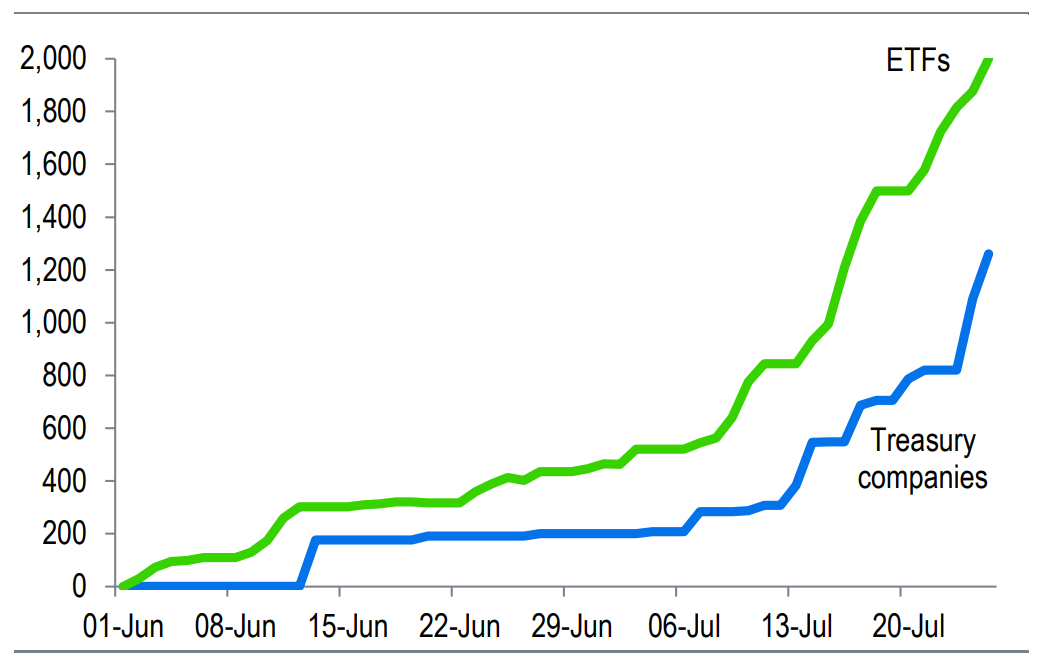

The rise of Ether does not only come from companies. Since the beginning of July there has also been a strong influx of capital via American Ethereum funds on the stock exchange. In nineteen consecutive days, money came in, good for a total of more than 5 billion dollars.

According to market researchers from the Bank Standard Chartered, this is just the beginning. “We think that companies can possibly possess 10 percent of all ether in the long term,” the bank writes in a recent report. That growth could be faster than with Bitcoin, partly because of the possibility of using ether for so -called stake, where owners receive interest.

Strategic role of Ethereum

According to analyst Enmanuel Cardozo, it is clear that companies not buy Ether just to hold. “They use the asset within their wider strategy,” he says. “That is a difference with the first phase of business Bitcoin adoption, which started much more passively.”

The growing business demand and the strong inflow into investment funds may possibly push Ether towards the psychological limit of 4000 dollars. Nevertheless, the price record from 2021, of almost $ 4900, is still 21 percent higher.

According to Cardozo, current developments are primarily a harbinger of a longer revaluation of Ether. “It’s not about next week’s course,” he says. “What we see now is the start of a structural shift.”

Source: https://newsbit.nl/zakelijke-crypto-schatkisten-overschrijden-grens-van-100-miljard/