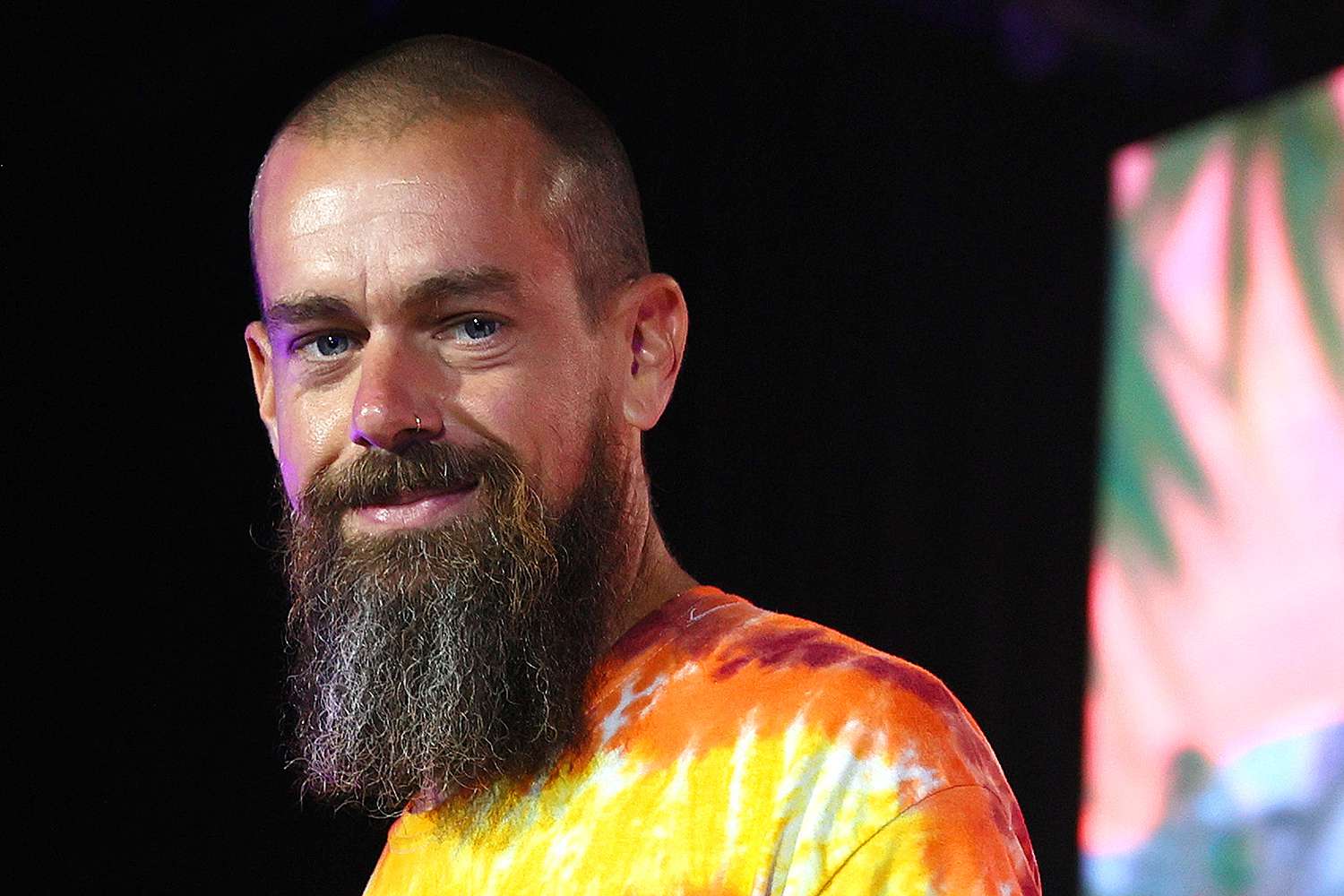

Jack Dorsey, known as the founder of Twitter and a distinct Bitcoin (BTC) fan, gets a new milestone with his payment company Block. The company will soon be added to the S&P 500 – the most important stock index of the US. Investors responded immediately: the share raised by more than ten percent on Tuesday evening.

Block buys Bitcoin and supports Lightning Network

Block, which was known as Square until 2021, is active on several fronts within payment transactions. The company owns, among other things, a cash app, a popular app with which users can easily transfer money and buy, sell or send Bitcoin.

In addition, there is the Square platform, a payment system for retailers and entrepreneurs. Block recently announced that from 2026 this system will also support Bitcoin payments via the fast Lightning Network. The company thus takes the next step towards the integration of crypto in daily payment transactions.

Bitcoin plays a central role internally. Block owns 8,584 BTC and calls the digital currency an essential part of its business strategy.

Crypto breaks on on Wall Street

The inclusion of Block in the S&P 500 confirms a wider trend: crypto-oriented companies gain ground within traditional financial markets. Only two months ago Coinbase also had a place in the index. And also MicroSstratey, the company of Bitcoin investor Michael Saylor, meets the criteria for admission.

This means that millions of investors, often through index funds, now indirectly invest in Bitcoin. Even if they do not make a conscious choice for that themselves.

Share Block increases sharply, but remains under record

The Block share rose by more than ten percent to $ 72.80 this week. On a monthly basis, the increase even comes to more than fourteen percent.

Yet the recovery is not yet complete. In 2021 the race peaked at 275 dollars. The current value is therefore still well below that top: less than thirty percent of the old record.

Source: https://newsbit.nl/jack-dorseys-block-maakt-intrede-in-sp-500-aandeel-schiet-10-procent-omhoog/