The AEX course is unable to force a definitive breakthrough. In February 2025, the provisional all-time high of 952 points was put on the signs, and the AEX has trouble getting back there. A hard rejection follows every rapprochement.

Today the fair opened almost 10 points lower on 913 points, which is good for a decrease of 1.06 percent.

Warmer inflation figures vs print the course?

It is starting to look like Donald Trump’s taxes are slowly finding their way to the American inflation figures. To date, we saw inflation in particular, and people started to ask themselves to what extent the taxes caused inflation.

Now we see inflation warming up, and there is a chance that people will worry about it.

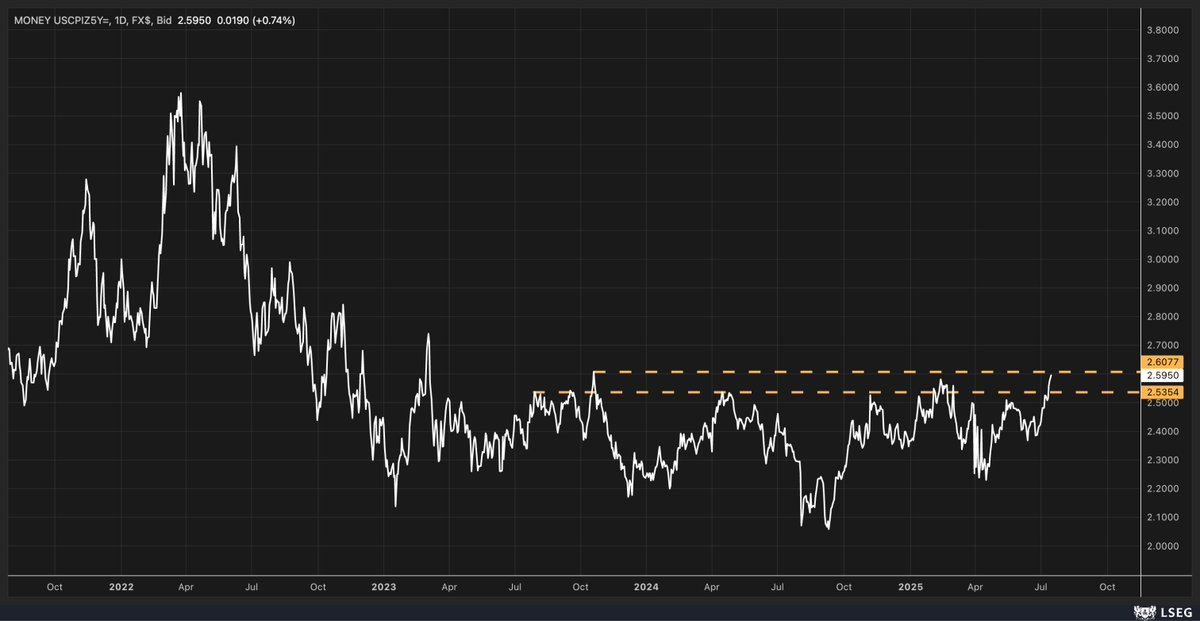

The same applies to the 5-year expectations for inflation (graph above), which seem to be working on an outbreak.

This can potentially be a brake on the AEX course, because the US central bank has less room for interest rate letings. Exactly the opposite of what Donald Trump wants, and he seems to cause that himself with his taxes.

Is this really a problem?

However, it is still too early to say whether there is really a new inflation problem. That is probably not the case, but we have to deal with a world in which inflation is structurally a bit warmer than before.

Among other things because of the taxes, but also through the budget policy of the United States and other great authorities. Great powers around the world work with considerable budget deficits and seem to want to increase them rather than reduce.

That is good for the world economy, which means that companies will invest more. This also creates inflation, because those companies will all “offer” on scarce raw materials. The demand for raw materials is increasing, and therefore inflation increases.

In the short term, however, this could cause some panic among investors, because it expects fewer interest rates from the US Central Bank.

Source: https://newsbit.nl/aex-koers-omlaag-na-warmere-inflatiecijfers-in-de-vs/