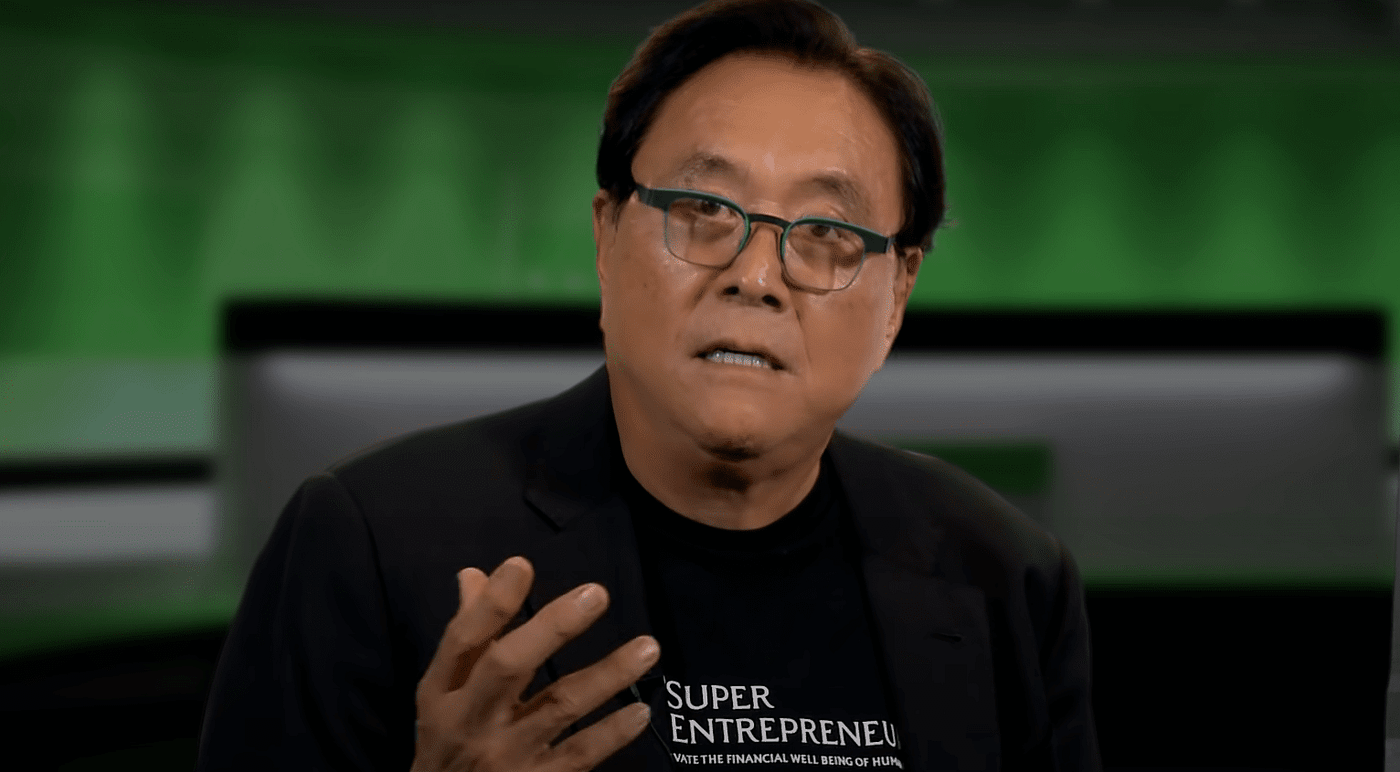

The famous author of the book Rich Dad Poor Dad, Robert Kiyosaki, made himself heard again. He does not hide his love for Bitcoin (BTC) and explains why he finds it a better value storage than gold.

BTC as “ultimate” scarce asset

Kiyosaki indicates that Bitcoin is a unique value storage thanks to the fixed maximum stock of 21 million coins. According to Kiyosaki, this makes the Digital Activum more reliable than traditional raw materials such as gold and silver. According to the American, the fixed stock ensures predictable scarcity. “With gold and silver, production can increase when the price rises,” he explains. “If the value of gold goes up, I can simply more mines. But with BTC it is different, there will never be more than 21 million coins.”

The special thing about Bitcoin is that it has a mathematically determined maximum and will always continue to exist worldwide. This is different with gold and silver. Although stocks on earth are currently limited, it would be theoretically possible to win gold in the future on other planets or asteroids. If the time comes, it could considerably reduce the value of the precious metal.

Protection against economic crises

Although Bitcoin has a special place in the heart of Kiyosaki, he is also still positive about gold and silver. He sees all three assets as safe ports in case the global economy collapses, a scenario that he has been warning about for years.

Although Bitcoin has the strongest scarcity element, according to Kiyosaki, he predicts that silver can show the greatest growth in the short term. The demand for silver increases in sectors such as solar energy, electric vehicles, electronics and medical equipment. He expects that the price of silver can even double by 2026.

But in the long term? Then it’s a different story. Then Kiyosaki even expects the BTC rate to reach $ 1 million.

Source: https://newsbit.nl/robert-kiyosaki-onthult-waarom-bitcoin-beter-is-dan-goud/