The commercial war escaped by the United States and the appreciation of the euro at its crossroads with the dollar pave a new cut of the interests of the European Central Bank (ECB). Some experts point out that the Governing Council of the monetary institution should put on the table even an official ‘price’ of the money in the half -point eurozone, from 2.5% to 2%, although most consider that the cut after their meeting this Thursday will be 0.25 points. It will be the sixth consecutive decrease in this same caliber, and the seventh since June 2024.

The uprising of the euro “pressures inflation,” says Jumana Saleheen, chief economist for Europe of the Vanguard manager, in statements collected by the ‘Bloomberg’ agency. “The cost in euros of some imported goods and services, those quoted in dollars [principalmente el petróleo y el gas]it is decreasing due to the depreciation of this currency [precisamente por la incertidumbre debido al daño de los aranceles a la economía de Estados Unidos]”Eric Dor, Director of Economic Studies of the IESE, coincides, as transmitted to eldiario.es.

The interannual inflation data in March in the Eurozone was moderated to 2.2%, compared to the same month last year. In Spain, it fell to 2.3%. This rate of uploading consumer prices is very close to the theoretical objective of the central banks. Its main mandate is that, keep the price increase controlled. Your tools to get it are two. One, direct intervention on interest rates, which moves to the Euribor and, therefore, to mortgages and credit in general. Two, indirect intervention on the cost of loans with their participation in the secondary debt market – in summary, creating money and buying bonds to reduce them or, on the contrary, selling those who have saved in their balance to make them more expensive.

With oil falling, the euro rising and uncertainty in the world economy for the commercial war, the ECB is in a scenario in which the 2% inflation objective can be taken for granted. “The United States protectionist policy should reinforce inflation in the eurozone,” admits Eric Dor. “This is partly due to its recessive effect on the demand for exports and in part to the induced increase in supply, in the European market, of local or foreigners whose demand will decrease in the United States,” explains this expert.

“Of course, the increase in European customs tariffs on goods from the United States, as a reprisal measure, would raise certain eurozone prices. But the deflationary impact would be greater,” he continues.

Economic growth stagnation in the Eurozone

The concern then becomes another, specifically the stagnation of economic activity at one time in the countries of the European Union (EU) are being forced to increase the expense in defense and in which it is again necessary to invest in the energy transition, in the digital and in help plans to advance in what they are calling “strategic autonomy”, which comes to mean that it must be dependent less than the exterior of the international climate of absolute climate. For all that, ‘cheap’ money is needed.

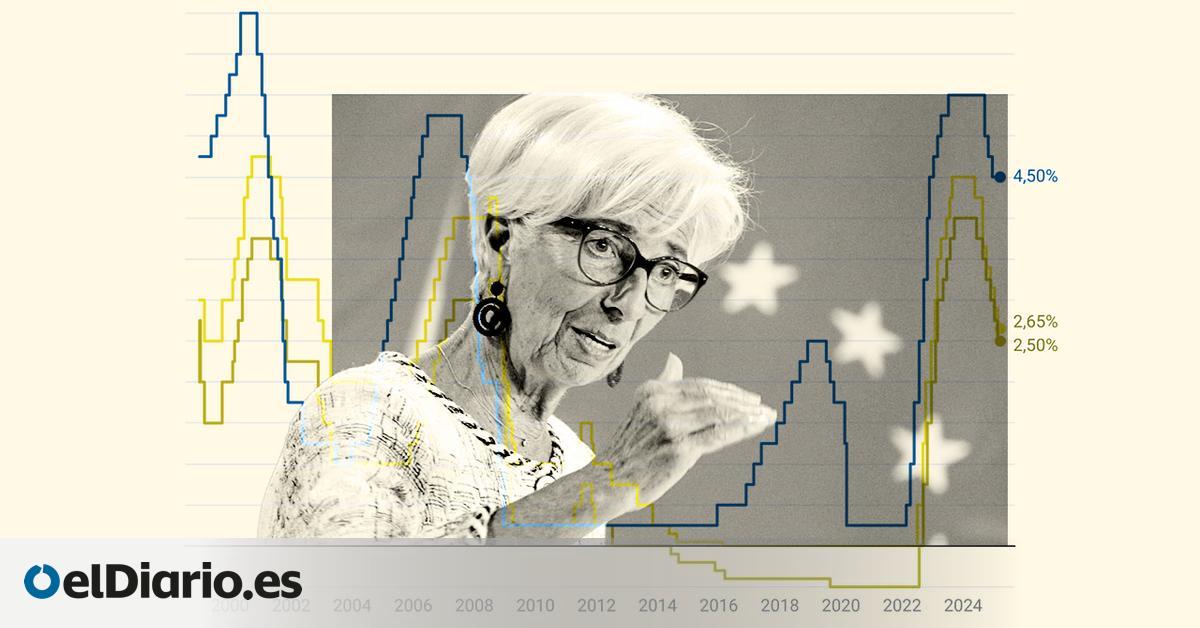

From 2022 to mid -2024, as can be seen in the graph of this information, the ECB, the United States Federal Reserve and the rest of the central banks more expensive and hindered access to financing to drown companies and families and thus moderate inflation. It was an aggressive monetary austerity cycle that brought the 4% reference interest rates in the eurozone, and up to 5.5% in the United States. Since June of last year, the road is the opposite.

“It is very plausible that the ECB decides to cut its interest rates 0.25 points this Thursday. The type of deposition would fall as well as 2.25%. Since the macroeconomic situation is extremely uncertain, in particular due to the erratic policies of the United States, the ECB will surely continue to avoid any prospective communication on the future direction of the types and indicate that the future decisions will depend on the data and in particular, in particular, in particular, in particular, the The factors that contribute to inflation, ”concludes Eric Dor.

“Those responsible for the monetary policy of the ECB [el Consejo de Gobierno, con la presidenta Christine Lagarde, el vicepresidente Luis de Guindos, y los gobernadores de los bancos centrales de los países del euro, como José Luis Escrivá] They maintain the course, imperturbable to storm. The results seem quite safe: a cut of a quarter of a percentage point, along with some concern to the growing uncertainty. That will not change the course of the economy, ”laments economist Marcus Ashworth in a recent tribune.

“The ECB should cut 0.5 points and take the initiative before there is nothing left to take advantage of. In addition, there is the rise in the euro: a stronger currency will only aggravate the negative impacts on the eurozone economy, further making the growth of its industrial base further difficult,” affects this expert. The ‘common’ currency has appreciated 10% against the dollar since the beginning of January.

In March, both the ECB and the Federal Reserve (the FED, the Central Bank of the United States) cut their prospects for economic growth. In the case of the Eurozone, until they are left below 1% for all the partners, with the only positive exception of Spain, as the IMF then corroborated. With the passing of the weeks, President Lagarde herself has acknowledged that the commercial war will subtract another half point from the progress of the GDP of the Eurozone if she continues to climb in the coming months.

“If after the meeting last March, the market was assumed that we were closer and closer to the level of arrival [en este ciclo de recortes de los tipos de interés] And there was talk of a pause in the descent process, now [ese horizonte de medio plazo] It is closer to 1.5% to try to stop the economic slowdown to which the tariff war seems to lead us, ”says Cristina Gavín, head of rent and fund manager of Iberceja.

Meanwhile, the Federal Reserve faces a much greater dilemma. “A rapid deterioration of growth prospects and too high inflation expectations,” according to the team of economists from Swiss manager Julius Baer. A situation that has separated its type trajectory from the ECB. The Central Bank is waiting to analyze the decisions about the tariffs of the Donald Trump administration, and its consequences.

This same week, the president of the Atlanta Federal Reserve, Raphael Bostic, emphasized that the United States Central Bank must expect more clarity about the policies of President Donald Trump before adjusting interest rates. “The specific course of the economy depends crucially on the details of the policy,” he said.

Source: www.eldiario.es