It is currently raining all-time highs on the financial markets. The gold price has reached peak after peak and the S&P 500 has already made 47 all-time highs in 2024. Is Bitcoin lagging behind or should we not worry?

Free Financial Newsletter

Would you like to receive a full market update twice a week?

Then subscribe for free to my newsletter De Geldpers.

Roomy 3,000 bankers, fund managers, lawyers and investors went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Fantastic year for the S&P 500

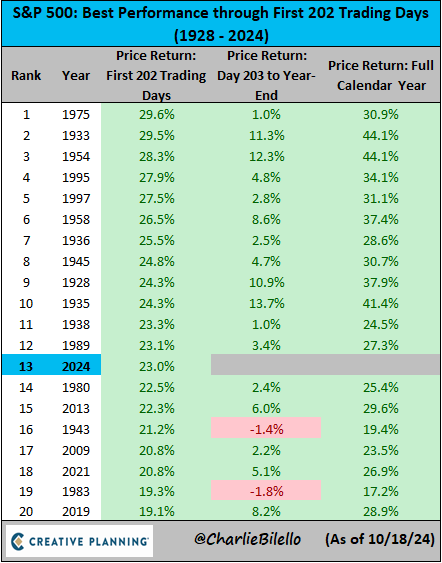

In any case, it is a fantastic year for the traditional financial markets. The S&P 500 currently has a return of over 24%, performing 4x better than average, and is having its best year since 1997.

Isn’t it time for a correction? If we go by the historical data, the answer to that question seems to be: no.

In almost all years in which the S&P 500 started like in 2024, we ended with even greener numbers. In that respect, there still seems to be plenty of room for the American stock market index to grow.

Not least because the American economy looks healthy and the American central bank has started lowering interest rates.

But when does the party start for Bitcoin?

Things seem to be going a bit slower with Bitcoin. This causes doubts among many investors. If gold and stocks are performing so well and continuously making all-time highs, isn’t there something going on with Bitcoin? Shouldn’t we be concerned?

You might conclude that something is not going right for Bitcoin. Based on the performance of the past few months, that is justified, or at least justified to be a little concerned.

After all, we can hardly say that it is a good thing that Bitcoin has lagged behind in recent months.

However, if we measure from the beginning of the year, suddenly nothing seems to be happening for Bitcoin.

Measured from the beginning of the year, there is a return of 50.08%. for Bitcoin, while gold has to make do with 33.66%, and the S&P 500 and the Nasdaq are at more than 23%.

From that perspective, Bitcoin is suddenly the dominant asset class again. In my opinion, it is especially important to be patient and not to jump to conclusions. It may be that Bitcoin will soon take over the spotlight again.

Free Financial Newsletter

Would you like to receive a full market update twice a week?

Then subscribe for free to my newsletter De Geldpers.

Roomy 3,000 bankers, fund managers, lawyers and investors went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Source: https://newsbit.nl/het-regent-all-time-highs-wanneer-is-bitcoin-aan-de-beurt/