Western banks bet big, but BRICS+ accumulate gold and prepare the ground for a new financial order. Who will come out ahead?

In a change seismic what is shaking global financethe nations BRICS and its new allies are accumulating gold at an unprecedented rate, leaving Western investors struggling to keep up. Although the West shows signs of wake upwith rising ETF inflows in September, many warn that it may be too late. With inflation soaring and economic instability looming, timeless reality of the value of gold becomes impossible to ignore.

BRICS expansion is a golden coalition

At the end of this month, Russian President Vladimir Putin will host the first summit of the BRICS+ in Kazan from October 22nd to 24th. During the summit, the original BRICS members — Brazil, Russia, India, China and South Africa — will welcome the Egypt, Ethiopia, Iran, Saudi Arabia and United Arab Emirates (UAE). With this expansion, BRICS+ now represents more than 40% of the global populationpositioning itself as a powerful counterweight to the Western-dominated financial system.

The BRICS alliance announced that more than 30 countries have expressed interest in joining the economic bloc, and leadership continues to evaluate the inclusion of new nations. Gold has become a core tool in the coalition’s strategy for challenge economic dominance of the West. As BRICS+ nations increasingly use gold to diversify their reserves and hedge against inflation, the bloc is signaling its intention to reshape global trade and finance. The coalition, with its diverse economic powers, is united in its objective of reduce western influence and build alternative financial structures.

Disagreements between members: an obstacle to dedollarization

Attention is focused on the Kazan summit, where BRICS+ plans to outline their next steps, as we closely monitor updates from this meeting. However, reports have emerged of discord between members, specifically with India, regarding efforts to dedollarization. India’s foreign minister, S.Jaishankardeclared that India don’t intend challenge the US dollar, putting the country at odds with Chinese and Russian rhetoric. “We have never actively targeted the US dollar,” he said.

Western Investors: “Too Little, Too Late?”

With inflation in the US and Europe reaching levels not seen in decades, Western investors are finally awakening to the lasting value of gold as a safe haven. But financial experts warn that this perception could have arrived too late. As Western markets begin to see an increase in investment in gold, nations BRICS he comes silently accumulating gold for years. The strategic forecast of countries like China, Russia and India positioned them far ahead in global gold rush.

John Readedo World Gold Councilstated: “I’m hearing a lot of positivity about gold, but what keeps coming out is that people They don’t have as much gold as they would like. Demand was much greater than expected.”

Despite recent increases in gold ETFs in the West, they barely scratch the surface compared to huge BRICS reserves. Some analysts paint a bleak picture, comparing the West’s last-ditch fight to “bring a water gun to a forest fire”. The BRICS nations, they argue, have already built a golden fortressleaving Western investors trying to reach them while economic uncertainty increases.

The “Great Gold Exodus”: from West to East

Without the West paying attention, the coffers of COMEX and from LBMA are being systematically emptied in a dramatic transfer of physical gold and silver to the East. Market analysts describe this as a unprecedented wealth transferwith Asian investors, especially in China by you Indiaacquiring gold at record rates. Many see this movement as a decline in trust in the Western financial system.

Bai Xiaojunmarket reporter, monitors daily silver prices in Shanghai Gold Exchange (SGE) by you Shanghai Futures Exchange (SFE). Their reports consistently show that Chinese silver prices are, on average, 10% higher than Western spot prices, fueling the rush for gold and silver to the East.

This gold migration marks not just a financial phenomenon, but a geopolitical change. As Western coffers are emptied and Eastern reserves increase, the global balance of power may be changing, with the East gaining economic strength.

Western banks in a golden trap

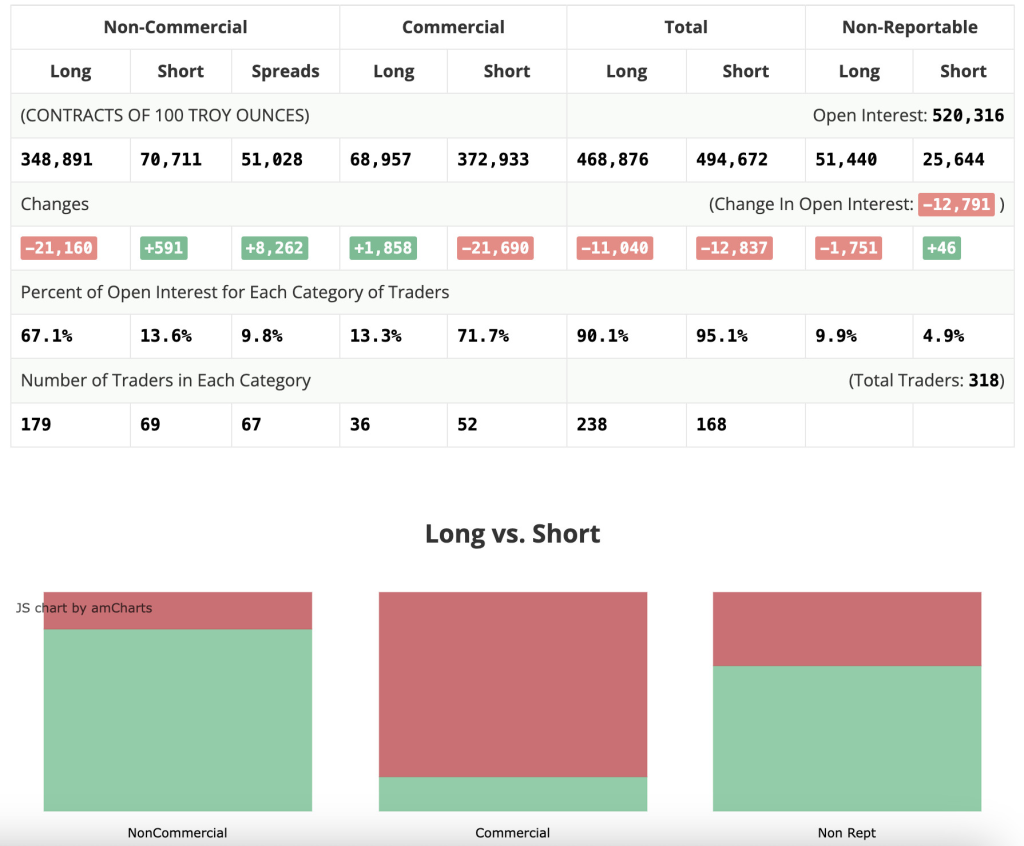

As the coffers empty, the western banks are being exposed by their short selling positions in gold, generating outrage in financial circles. These hidden positions led to accusations of manipulation deliberate pricing to maintain the illusion of dollar dominance.

With gold prices rising, this risky strategy is backfiring. As banks scramble to cover losses, nations like China and India are buying physical gold at prices bargaining. This rapid flow of gold from West to East is leaving many Western investors marginalizedwithout realizing that the game has changed.

The Big Alert: a new global financial order?

The growing scarcity of gold in Western coffers is alarming. Experts warn that the days of artificially suppressed prices are numbered and, when this house of cards financial collapse, it may be too late for the West to regain its golden safe haven. As the East continues to accumulate gold, pressing questions remain: How long can the West sustain this fragile balance? And, most importantly, What will happen to metal prices when these manipulations finally stop?

A Warning for Western Investors: Consider Physical Gold

This change serves as a called for Western investors to reconsider their strategies. The renowned investor Ray Dalio recommends allocating at least 15% of the portfolio for gold, emphasizing its importance. He stated: “If you don’t own gold, you know neither history nor economics.” As the global economic landscape changes, now may be the time to embrace the lasting value of gold.

By ERAN SUCH for The Jerusalem Post.

Source: https://www.ocafezinho.com/2024/10/17/brics-acumulam-ouro-e-bancos-ocidentais-se-afundam-em-dividas/