Rents have risen 30%. The price per square meter is close to that of the real estate bubble. And the increase in salaries does not reach one, nor the other, nor inflation. Only a third of young people can be emancipated before the age of 35 when, in reality, the term ‘young people’ makes the problem not seem so much like it. Nearly 1.3 million households dedicate more than one in every three euros of their salary to paying for their roof, an effort that international organizations consider “excessive.” Meanwhile, the rent of landlords, when they are not a vulture fund, doubles that of tenants.

With these figures, the movements for decent and affordable housing will demonstrate this Sunday in Madrid, in a mobilization that they anticipate will be massive, and in Barcelona, and the mobilizations will be repeated in the coming weeks in other cities. With the demand for a drop in prices and a call for a rent strike as leitmotifassistance in a country of property owners can define the course of social organizations, which hope that this day will represent a before and after in terms of public policies.

We explain in 10 graphs the nine problems that underpin the housing crisis in Spain.

Rents rise up to 30%

Between 2015 and 2022, rental prices have risen on average by 30% in Spanish metropolitan areas. Although the focus is usually on big cities, like Barcelona or Madrid, no one is spared. In Valencia, it has increased by 43% in less than a decade. In the Balearic Islands, 40%. In Malaga, 39%. And in Toledo, 35%. According to the analysis of rental data block by block from the State Reference System for Housing Rental Prices, carried out by elDiario.es, the trend affects both large and small cities and the most expensive areas, but also the most cheap

Several factors influence the increase in rental prices. One of them is the growth in demand for rentals, after an exodus of the population to metropolitan areas where finding a job is easier, which is combined with the difficulties in accessing home ownership, which increases the pool of tenants. . But the rise of tourist homes, which are extracted from the available park for residential use or the extraction of vulture funds, also influences.

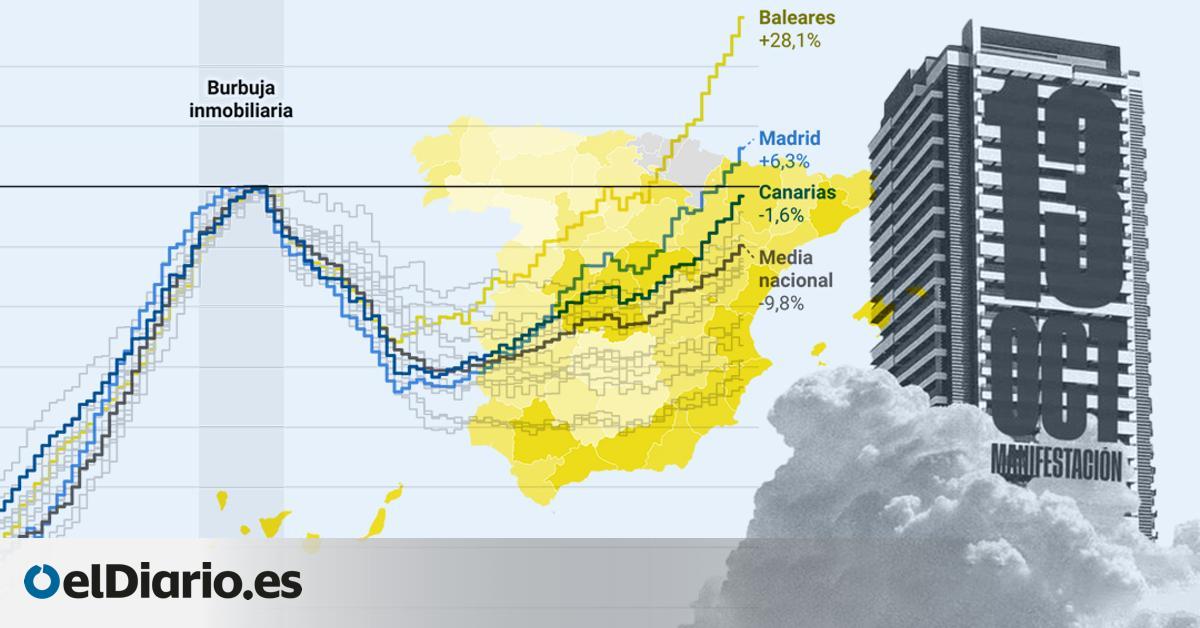

The purchase price is close to that of the bubble

When the real estate bubble burst in 2008, housing prices, around 2,000 euros per square meter, began to fall. They did so until 2013, when they rose again.

In most territories those levels have not yet been reached and the national average remains 10 points below, but some voices have been warning for some time that some patterns are being repeated. In the Balearic Islands and Madrid, buying a home today is more expensive than then and other communities, such as the Canary Islands, Navarra or Catalonia, are approaching the line drawn by the graph, according to the average appraised value of the free home.

“Buying and selling, for the majority of the population, is increasingly impossible, due to the price situation in large cities, the employment situation and mortgage conditions,” explained Melissa García, PhD in Geography from the University of Manchester. Lamarca in an article in the latest elDiario.es magazine, ‘Housing, errors of a failure announced’. “Housing is seen as an investment asset, there is a lot of interest and it has a more speculative value than a home for daily use,” he warned.

The increase in salaries, at the tail

Home purchase prices, rent, inflation and salaries rise. But the latter are in the queue. Between 2015 and 2022, salaries rose 17%, but even with this increase the working class has lost purchasing power, because inflation has since risen by more than 20%. With more income, they can buy less and have less savings capacity, while a greater part of the payroll goes to housing.

As can be seen in the graph, the rental price has risen 10 points above salaries and the average value of sales has increased 18 more points.

1 in 3 tenants spend more than 30% on rent

Both the OECD and the European Commission recommend not allocating more than 30% of your salary to housing, to make ends meet without difficulties. It is a maxim that the State Housing Law has adopted, but that almost 1.3 million homes in Spain cannot afford, according to microdata from the Living Conditions Survey of the National Institute of Statistics. There are 120,000 more families than in 2015. And, as the following graph shows, it especially impacts young people, those who live alone and single-parent households.

37% of people under 30 who live alone spend more than 30% of their income paying rent. 16% of adults between 30 and 64 years old allocate more than a third of their income to renting. For adults who live as a couple, the percentage of those drowning in prices is reduced by half. Among households made up of a couple over 65 years old, the percentage of those who make an excessive effort plummets to 2%.

Landlords double tenants’ rent

Having or not having a home configures the income levels. In fact, the average net income per household of those households that earn more than 200 euros per month from rent doubles that of tenants, with 4,395 euros compared to 2,252 euros, according to the analysis of microdata from the Living Conditions Survey. This medium has identified as landlords those households that receive more than 200 euros per month for renting a property. The figures show that the relationship is exponential: the more rent, the more rental income.

The data draws two other inverse graphs, showing the rent gap that divides landlords and renters. If wealth is analyzed by household, 27% of those in the poorest decile are renters, compared to 2.4% of landlords. At the other end of the scale the tables turn: only 7% of the most privileged decile live on rent, compared to 26.1% who are rentiers.

Only a third of the population can be emancipated before 35

This Sunday’s demonstration focuses on the fact that housing is not a business, on rental prices and on a group especially punished by this crisis: young people. According to the latest study by the Emancipation Observatory, the average age to form an independent home in Spain is 30.4 years, the highest since records began and far removed from the 26.3 in Europe. Currently, only 38% of young people between 20 and 34 years old live emancipated, according to data from the latest Active Population Survey.

According to data from the State Youth Council of Spain, a young person with a medium salary could not rent a home alone, even if they allocate their entire salary to it. This situation impacts those who cannot emancipate themselves, but also the conditions of those who do. “Just because a person lives outside the family home does not always mean that they have good conditions,” explained the president of the entity, Andrea Henry.

Double the effort to buy a home than 30 years ago

An increase in the sales price of housing that is out of step with the increase in salaries has a direct impact on the effort that the population has to make to buy a home. A recent report by the Barcelona Urban Research Institute (IDRA), seven out of 10 tenants do not know if they will be able to buy an apartment at some point in their lives. The Bank of Spain has estimated that a typical household should allocate more than seven full years of their income to acquire a free home of 94 square meters, the usual size.

This banking supervisor indicator has maintained some stability in the last decade, after skyrocketing in the years prior to the Great Recession and falling with the bursting of the previous bubble. However, it has never fallen to the levels prior to 2003. If analyzed from a generational perspective, a person of 30 years old – the average age of emancipation in Spain – will have to work almost twice as long to pay for a home they own. who bought her when she was born.

Tourist rentals drive out neighbors

The increase in housing for tourist use has put strain on the residential market. If they are intended for visitors, they cannot be occupied by neighbors. Thus, they now represent more than 4% of the total park in the Balearic and Canary Islands and in the province of Girona; 3.9% in Málaga, 2.9 in Cádiz and 2.8% in Alicante. And the situation worsens in some island municipalities, where they suppose 20% of the total.

Tourist homes are concentrated in central areas

Percentage that tourist homes represent in each district with respect to the total number of homes

Source: INE, 2021 Housing Census

The example of the four most populated cities in the country serves to illustrate how housing for tourist use is concentrated in the center and its presence decreases as they move further away. These concentric areas also explain the expulsion of a part of its inhabitants to increasingly remote areas which, in turn, push the rest. The Ministries of Housing and Tourism are working on regulations for this type of housing, which were outside state law, while some municipalities advance their own policies. Barcelona Mayor Jaume Collboni announced in June that he would not renew the city’s 10,101 licenses.

Real estate sector profits soar by more than 50%

The increase in the effort of households to face the increase in prices does not go in vain. Since 2015, profits from real estate activity, excluding the construction sector, have skyrocketed by 52%. The increase in intermediaries’ profits plummeted with the pandemic, but since 2021 profits have doubled. And they have done so despite the fact that sales have not grown, by any means, to the same extent. As the following graph shows, the two curves were even until 2019. Today, the difference is 34 points.

The graph also shows how the sector is getting richer without creating jobs. Intermediaries have seen their profits increase practically without increasing the number of employees, which has grown barely 2% in the last nine years.

Source: www.eldiario.es