The Bitcoin price has been under pressure for months. The bulls are unable to break above the range of $60,000 to $74,000. What does it take to do that? Lower inflation, so that the US central bank (Federal Reserve) can finally lower interest rates.

Next Friday could be crucial for Bitcoin for exactly that reason.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Friday crucial for Bitcoin

After last week’s positive inflation data – both the consumer price index (CPI) and the producer price index (PPI) were lower than expected – but the Federal Reserve wants to see more evidence that inflation is on its way to the desired 2.0%.

We can get that proof next Friday. Then it is time for the Core PCE price index, the Federal Reserve’s favorite inflation gauge.

It would be good for Bitcoin if it also turned out lower than expected. After all, that is what it takes to convince the Federal Reserve to make a first interest rate cut in September.

Yesterday’s macroeconomic data seems to make a positive contribution to this. Yesterday it was announced that Retail Sales (sales figures in American retail) were lower than expected.

What does this mean? The American consumer is weakening. They spend less than expected, which in theory should also reduce inflation. In theory, that’s bullish for Bitcoin as it brings interest rate cuts closer.

Can inflation still pick up?

That’s the positive story. Unfortunately, there is also a case to be made for a new revival of inflation – or at least inflation that remains sticky.

It has probably not escaped your notice that the stock market (and NVIDIA in particular) is performing fantastically. That makes Americans richer on paper, allowing them to spend more money.

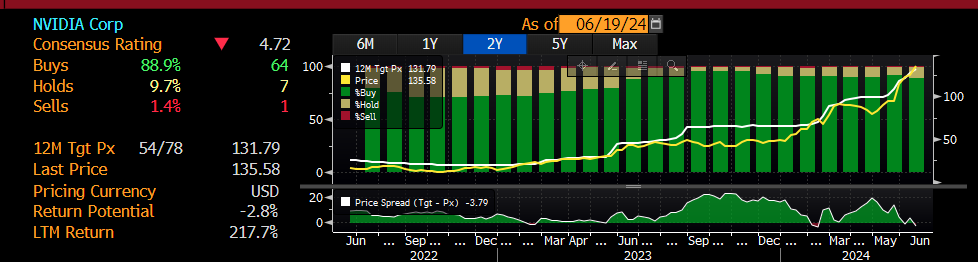

This is what we call the so-called wealth effect. We clearly see that NVIDIA is doing well in the Bloomberg data below. 88.9% of analysts believe you should buy NIVDIA, while there is only one person who would hit the sell button.

If inflation remains high due to this development, it could still depress the Bitcoin price in the coming months. In that respect, an exciting period is coming.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/volgende-week-vrijdag-cruciaal-voor-bitcoin/