The AEX price opened flat again today and appears to be cautiously forming a bottom around 904 points. At the moment, the market is mainly awaiting the American inflation data. The PCE Price Index, the US central bank’s favorite inflation gauge, will be released at 2:30 PM Dutch time.

Interest rates and financial prices will undoubtedly react volatile to this.

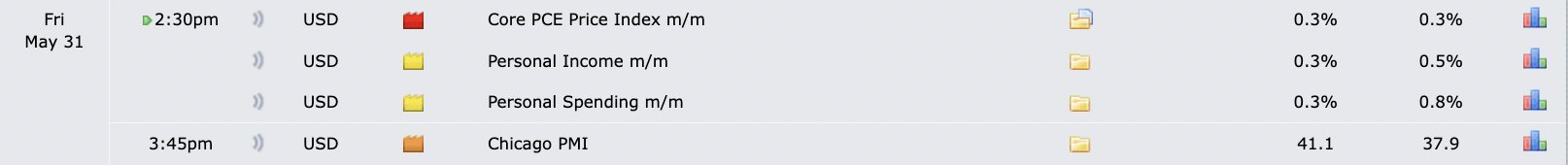

PCE Price Index on the agenda

So today the market is under the spell of the United States and the inflation figures that we are presented there.

The chart above from Bloomberg shows how inflation has fallen in recent months, but also appears to be plateauing. Although there are certain components that really pull inflation down with falling prices (durable goods), most components still cause inflation.

For now, the PCE Price Index is expected to have risen 0.3% in the past month. On an annual basis, that would still result in an inflation rate that is too high to simply lower interest rates.

While those interest rate cuts are necessary for the AEX price and other financial assets to start a new recovery.

Inflation in the Eurozone is rising

In the Eurozone, inflation has risen from 2.4% to 2.6% and core inflation even from 2.7% to 2.9%. Despite this, the market expects an interest rate cut from the European Central Bank next week.

“Economists have scaled back their expectations for the European Central Bank’s interest rate cuts, according to a recent Bloomberg survey,” said Lynx’s Kevin Verstraete.

Previously, the market was betting on six cuts of 0.25%, while they now expect an interest rate of 2.75% for June next year. This would result in five reductions of 0.25% from the current level.

This could possibly give the AEX the support it needs to rise towards all-time highs again.

Source: https://newsbit.nl/aex-koers-lijkt-voorzichtig-een-lokale-bodem-te-vormen/